If you’ve been donating your 10c container refunds through Tasmania’s Recycle Rewards app, you’ll want to make sure you can easily claim your donations at tax time. The app includes a built-in feature to generate a PDF donation summary—but it’s not always obvious where to find it.

Synectic Accountant Luke Brydon has prepared a step-by-step guide to help you export and save your donation records so they’re ready to forward to us at tax time.

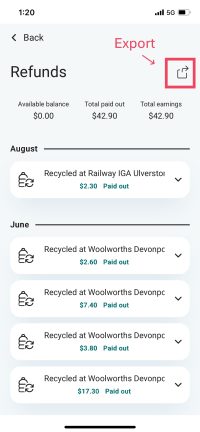

Step 1: Go to the Refunds Page in the Recycle Rewards App

Log into your account as normal. From the home screen, select Refunds, which shows your earnings and transactions.

Step 2: Go to Export

In the top-right corner, tap the Export icon (a box with an arrow pointing out).

Step 3: Request Your Donation Receipts

A pop-up titled “Send tax deductible donation receipts” will appear.

Choose the date range (e.g. the current financial year).

Confirm your email address (it should pre-fill automatically).

Tap Send.

Step 4: Check Your Inbox

You’ll receive an email from Recycle Rewards containing a secure link.

Open the email and follow the link.

Download the attached PDF donation summary.

- Save it in a dedicated folder with your other tax records.

Step 5: Save and Share Your Records

Store the PDF in a dedicated folder with your other tax records for safekeeping.

Share the file with your accountant or upload it with your tax documents when lodging your return.

Why This Matters at Tax Time

Your exported PDF will only include eligible, tax-deductible donations. This means your tax return will be easier to prepare and more accurate.

Simply share the file with your accountant or upload it with your tax documents when lodging your return.

Tip:

Always double-check the date range before sending the report to ensure it covers the financial year you’re lodging.